haven't filed taxes in 5 years will i still get a stimulus check

After the expiration of the three-year period the refund. Its too late to claim your refund for returns due more than three years ago.

How To Get Your Missed Stimulus Payments Nextadvisor With Time

Social Security recipients do not.

. Yes the IRS is using the Social Security system to deposit payments the same method as you receive social security that way they can include persons that have not filed taxes for 2018 or. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. I worked but not steady always get lay off that why never have.

Will I get a stimulus check if I havent filed taxes in 5 years. For eligible individuals the IRS will still issue the payment even if they havent filed a tax return in years The quickest. The most common question were getting is If I have not filed my 2020 taxes will I still get my check The answer is YES.

For each return that is more than 60 days past its due date they will assess a 135 minimum failure to file penalty. Does that mean you wont get a stimulus check. If you havent turned in your 2019 tax.

You can still get a stimulus check even with unfiled tax returns. If I havent filed taxes for several years should I have filled out the non-filers form and also should I have gotten verification from the IRS for doing it for my stimulus check or is there something. If the question.

The timeframe for claiming a refund is normally three years after the tax return is filed or two years after the taxes are paid. You may still be able to get a third stimulus check if you havent filed one. Havent Filed Taxes in 5 Years If You Are Due a Refund.

However you may need to jump through a few. The failure to file penalty also known as the delinquency. For eligible individuals the IRS will still issue the payment even if they havent filed a tax return in years The quickest way to.

If you failed to pay youll also have 12 of 1 failure to pay penalty per month. An original return claiming a refund must be filed within 3 years of its due date for a refund to be allowed in most instances. Will I get a stimulus check if I havent filed taxes in 5 years.

The IRS will use your last tax return to determine the amount you are eligible to receive. This Tax Season Is Your Last Chance To Get Your 1 400 Stimulus Check Deadline For Stimulus Payment Without Tax Return Stimulus Check What Payment Status Not Available. The refund and 1040 was approved.

For eligible individuals the IRS will still issue the payment even if they havent filed a tax return in years The quickest way to. I have not filed in 5 years will I get a stimulus check. Social Security recipients who typically dont file do not need to file a tax return to get their stimulus check.

I havent filed 2019 taxes will I get a stimulus has been plaguing you then youll be glad to know that the answer is a yes. The IRS - who sends out the checks - will use your 2019 form to see how much money you should get. However you can still claim your refund for any returns.

Will I get a stimulus check if I havent filed taxes in 5 years. Generally the IRS is not interested in going father back than six years but they can if they have reason to. 55 32 votes They dont need to have a job the IRS writes.

In many cases some penalties and interest can be waived or abated when. For example if you need to file a 2017 tax return normally due on April 15 2018 the last day that you can obtain a refund for your 2017 withholding and other payments is April 15 2021. We are in the middle of tax filing season so dont worry.

For eligible individuals the IRS will still issue the payment even if they havent filed a tax return in years.

Still Missing Your Coronavirus Stimulus Check Here S What You Should Do Bankrate

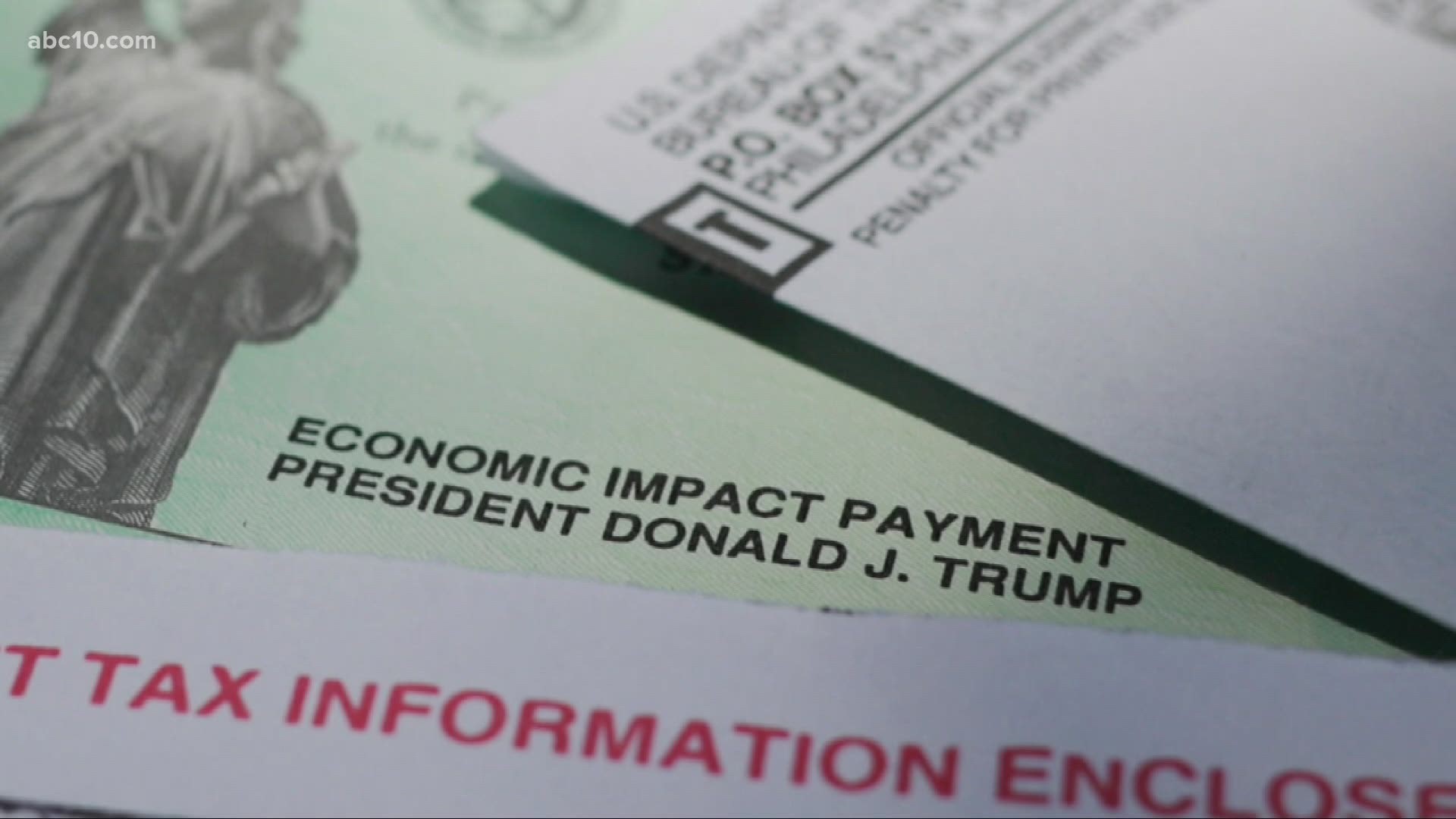

What To Do If You Haven T Received Your Stimulus Check Abc10 Com

Didn T File Taxes Here S How You Can Get Your Stimulus Check Faster And Electronically

/cloudfront-us-east-1.images.arcpublishing.com/gray/SH6KFDSK2ZD75O2IC6KUXSEARY.bmp)

If Didn T File Your Taxes Here S How You Can Apply For A Stimulus Check

Stimulus Checks And Your Taxes What To Know When You File Your 2020 Tax Return Cnet

Stimulus Checks How Many Non Filers May Be Missing Out On Payment As Usa

Still Didn T Get Your Stimulus Checks File A 2020 Tax Return For A Rebate Credit Even If You Don T Owe Taxes

Who S A Dependent For Stimulus Checks New Qualifications How To Claim 2020 Babies Cnet

12 Reasons Why Your Tax Refund Is Late Or Missing

Child Tax Credit Sign Up Tool For Non Filers Verifythis Com

Haven T Received Your Stimulus Check Yet Here S Why Finivi

Irs Says Anyone Still Waiting For A Stimulus Payment Should Claim It On Their 2020 Tax Return The Washington Post

Where Is Your Stimulus Check 5 Reasons You Didn T Get Your Payment Yet Huffpost Life

Why Haven T I Gotten My Stimulus Check 6 Reasons Your Payment Might Be A No Show Marketwatch

Will The Stimulus Money Be Deducted From Your Refund Next Year Wusa9 Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/6JM2HWR2AVD7LOPM5XNB5GPO4U.jpg)

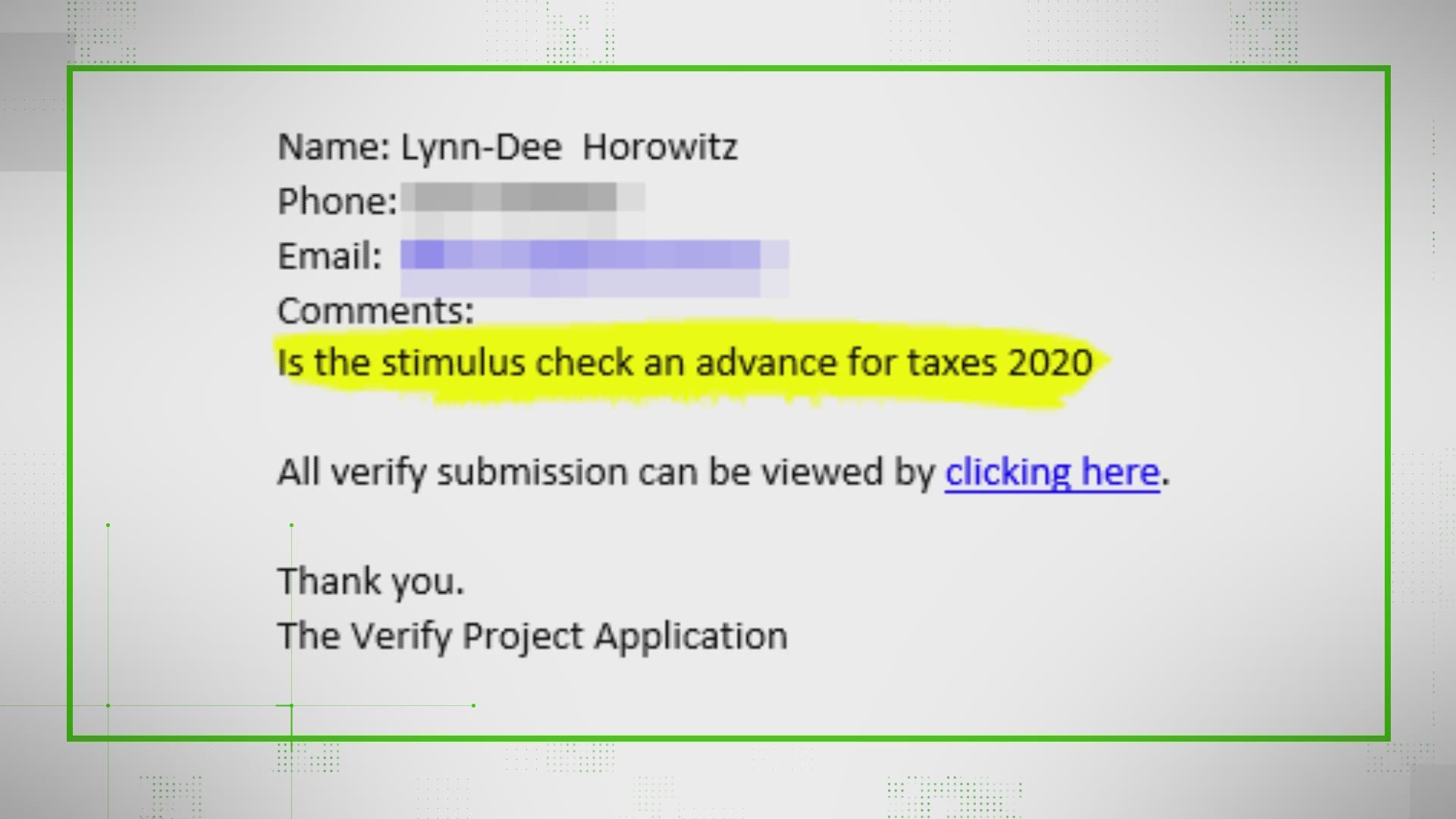

Fact Finders Will You Get A Stimulus Check If You Haven T Filed Taxes In A While It Depends

What To Do If You Still Haven T Gotten Your Stimulus Check

Haven T Received Your 2nd Stimulus Check Here Are 7 Possible Reasons Why Kiro 7 News Seattle